The Zest Car Hire Insurance Guide provides all you need to know about the complexities of rental car insurance!

Contents

- Introduction to car hire insurance

- Common car hire insurance terms explained

- Car hire insurance excess

- Collision damage waiver (CDW)

- Theft protection / theft waiver (TW)

- Third-party liability and public liability

- Zero excess liability

- Excess reimbursement insurance (ERI)

- Difference between ERI and zero excess

- How to tell if you have ERI or zero excess

- Zest’s Top-up insurance

- Provider’s selling their own insurance at the desk

- Damaging a rental car – what to do

- Car hire insurance frequently asked questions

1. Introduction to car hire insurance

Car hire insurance is the protection applied to the rental car while it is being rented. This is vital to every rental as it protects you, the car rental provider, and the car itself.

Car hire insurance is a blanket term for the ways in which these protections can be applied to your rental. They vary from the basic packages applied to almost every rental like CDWs, to more comprehensive but often optional insurance packages like our own Top-up insurance. Most car hire providers will have their own form of car hire insurance which you can choose to take out if you wish.

Remember: While these protections are often labelled as car hire insurance, not all protective methods are actually insurance. CDW is a common example of this.

1.1. How car hire insurance protects you

Car hire insurance protects you by decreasing how liable you are to pay for damages to the vehicle under certain circumstances. If you had a collision in a rental car without any coverage, you’d most likely have to pay for the full cost of repairing the car.

1.2. How car hire insurance protects the car hire provider

Car hire providers need to have adequate insurance coverage on their rental cars to ensure they don’t have to pay for all the damage that may be inflicted on their fleet.

1.3 Types of car hire insurance

Not everything labelled as car hire insurance offers the same coverage and not everything that is labelled as insurance is actually insurance. More detail on the varying types of protections will be provided further below.

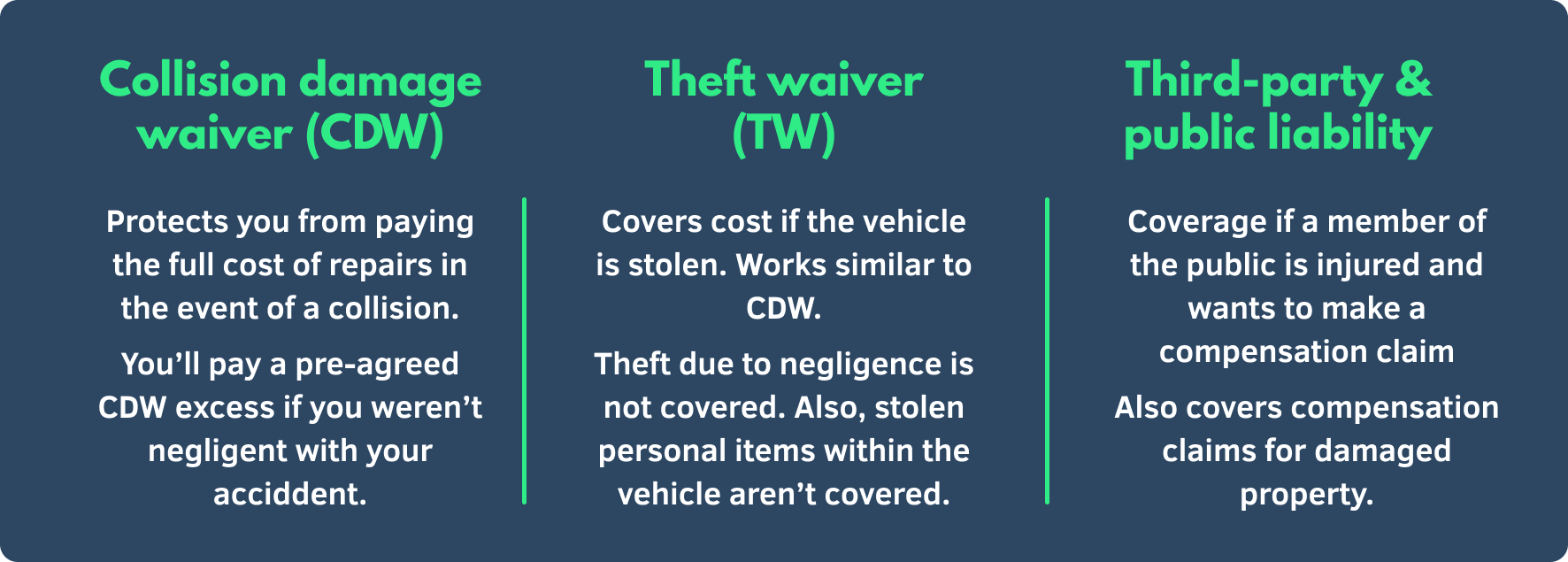

Type 1: Protections that are mostly standard and included with every hire.

These protections are the basics. They’re included with practically every rental and when lumped together, can be thought of as a very basic third-party car insurance policy.

- CDW / Collision Damage Waiver

- TW / Theft Waiver

- Third-Party and public liability

Type 2: Upgraded protections sold during booking or collection.

These cover more of the car and reduce how much you’d have to pay in the unlikely case of a collision. These include:

- Our own industry-leading Top-up insurance.

- The additional insurances offered by all car hire providers.

- The extra insurances offered by other car rental brokers.

Why do you need upgraded protections if the car is covered by the free, standard protections?

Those standard protections do not cover you fully. They only cover certain parts of the vehicle and in the event of an accident, you’re still liable to pay the excess.

1.4. When will you not be eligible to make a claim?

Even if the car rental damage is eligible under your coverage scheme, in some scenarios you may not be able to claim if you fail to take appropriate care of the vehicle.

Negligence

Being negligent is the breach of a duty of care that results in damage. This will absolve you from using any included standard coverage or additional purchased insurance. The following scenarios will be labelled as negligence and you will not be covered:

- Drink driving or driving without due care.

- Driving off-road.

- Misfuelling.

- Loss or damage to car keys.

- The car is stolen after keys are left in the ignition.

No damage report

Failure to fill out a correct damage report could invalidate any insurance you have, leaving you liable to pay for the damages. Provide the maximum amount of evidence to ensure you’re liable.

Follow these key steps:

- Inform the provider immediately (contact Zest customer support if you can not reach them).

- Complete a damage report by taking lots of photos and finding any witnesses if possible.

- Obtain a police report immediately.

- Acquire the details of a third party if they’re involved.

If you aren’t negligent, following these steps will ensure you’re eligible for your standard or additional coverages.

2. Common car hire insurance terms explained

2.1 What is a car hire insurance excess?

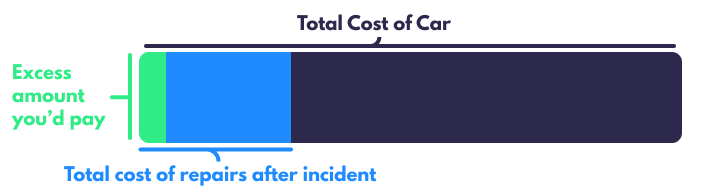

When we talk about a car hire “excess”, we’re talking about the small portion of the full cost of repairs that you’d be liable for in the unfortunate event of an accident.

This is the same as the excess you’d pay on your own car insurance or home insurance. The amount of excess can vary between brokers, car hire providers, and even the type of car you’re booking.

It is possible to claim back the excess amount you pay following your booking with our excess reimbursement policy. Furthermore, we offer bookings where the excess is zero! More details on zero excess will be provided below.

2.2 Collision damage waiver (CDW)

What is a car hire CDW?

CDW isn’t insurance in its own right. It is a basic cover that waives your responsibility for the full cost of repairs in the event of collision damage. A CDW protects you from having to pay for:

- Loss or damage to the vehicle, whether or not it’s your fault.

- The cost to repair or replace the vehicle if it’s written off.

- The loss of income to the provider while the vehicle is being repaired.

Without CDW: you could be liable for the full cost of repairing the rental vehicle if any damages were to happen.

With CDW: except in rare and negligent cases, the most you’ll pay in the event of damage to the car is the pre-agreed CDW excess. This payment is often far lower than the full cost of repairs but can be as high as £2,000 regardless of if it is your fault.

Example: If you hire a Ford Fiesta and it’s written off in a collision, you’re not liable for the full €17,000 value of the vehicle. With the CDW you’ll only be liable to pay the pre-agreed excess fee which is a significantly lower amount than the full cost of the replacement. This is assuming the collision isn’t caused by negligence on the driver’s part which would then void the CDW.

Does CDW cover every part of the car?

No, CDW generally does not cover certain areas of the car such as:

- The windscreen

- Wheels (tyres and rims)

- Undercarriage and roof

If these parts were damaged individually, outside a collision, the provider would charge you the excess. For example, if there was a windscreen chip or a flat tyre, the CDW would not cover these.

If you wish to cover damage to these parts, you should purchase our additional Top-up insurance. Please note that due to stipulations from the third party this is supplied through, certain countries of residence are excluded from eligibility and this cover can not be purchased.

Will I ever have to pay a higher amount than the excess?

In some rare cases, yes. If severe damage were to happen to parts of the car not covered by the CDW, you’d be liable for the full cost of repairs which may amount to more than the excess amount.

How do I know if I have a car hire CDW?

CDW is always included when booking with Zest Car Rental with either no insurance excess or Excess Reimbursement Insurance (ERI). These will be discussed further in the guide. Some other firms or brokers offer CDW and theft waivers but with a huge excess to pay if any damage occurs.

2.3 Theft protection/theft waiver (TW)

An equivalent of CDW but protects against theft if the vehicle is stolen. Unfortunately, the Theft Waiver DOES NOT cover theft of items within the vehicle – purchasing a holiday/travel insurance will cover this if you need protection on your personal items. Theft because of negligence, such as leaving the keys in the ignition is NOT covered.

TW is always included when booking with Zest Car Rental with either no insurance excess or excess reimbursement insurance.

2.4 Third party liability and public liability

This covers you if a member of the public makes a compensation claim against you because they believe that you are responsible for their injury, or for their property being damaged. This is essentially the same as with standard car insurance. This is also sometimes called Supplemental Liability Insurance or SLI.

Again, this is always included when booking with Zest Car Rental.

2.5 Zero excess liability

Zero Excess Liability is what we try to provide with all our bookings. It offers maximum peace of mind in the case of a collision with another vehicle. In the event of an accident, you won’t have to pay the excess providing you follow the correct procedure which we’ve outlined below.

This kind of protection doesn’t always cover all types of repairs, damage to certain parts of the car are excluded. The wheels, tyres, and glass parts are all excluded within Zero Excess Liability. Always check with our customer support team if you are unsure about whether you can claim.

I’ve got Zero Excess liability and I’ve had an accident, what do I do?

- Contact the provider and let them know. Their contact details are on your car hire voucher. If you can’t get hold of the provider, let us know.

- Complete a damage report on the car. Be sure to take photos of the damage, the roads, and find any witnesses you can use as evidence.

- Obtain a police report immediately, this is essential.

- If a third party is involved, get their details too.

If you follow all these steps properly and you haven’t been negligent, you won’t be liable to pay the excess for the collision.

2.6 Excess reimbursement insurance – ERI

Sometimes known as Excess Protection, ERI allows you to be reimbursed for the insurance excess should your hire car be damaged or stolen. This is the alternative insurance to zero excess liability when we can not negotiate it with the client. Both schemes however still offer zero excess but with a slight difference.

Excess Reimbursement Insurance allows you to claim back the excess amount after you return home, instead of claiming it whilst still in the rental process. You’ll still have to pay the excess at first, but as soon as you get home you can claim this money back. This process is really simple and easy to do.

I’ve got excess reimbursement insurance and I’ve had an accident, what do I do?

- Inform the provider immediately, their contact details are on your car hire voucher. If you can’t get hold of the provider, let us know instead.

- Complete a damage report on the car. Take photos of the damage, the roads, and find any witnesses you can use as evidence.

- Obtain a police report straight away, this is essential as you may need to use it as evidence.

If you follow these steps properly and you haven’t been negligent. You should be able to claim back the excess.

2.7 Key differences between ERI and zero excess

These types of cover ultimately aim to protect your excess after an accident, they work slightly differently to do this.

What’s the difference?

Zero excess liability is provided by the provider, ERI is provided by us.

Zero excess means you won’t have to pay the excess in the case of a collision.

ERI means you’ll have to pay the excess at the time but you can claim it back afterwards.

Still confused? Check out our guide on the differences between ERI and Zero Excess Insurance which goes into further detail.

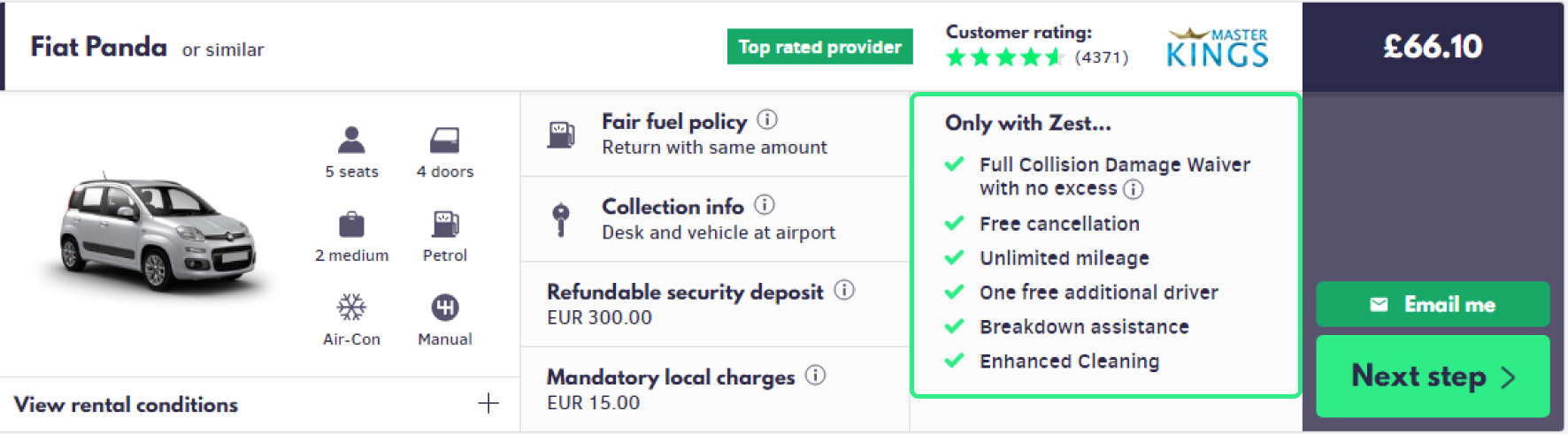

2.8 How can I tell if I have ERI or zero excess?

After booking: You can check on the car hire voucher you received on the page titled “Rental Conditions” under the heading “Insurance”.

While booking: To see which kind of cover you’ve got under, look for the “Only with Zest…” heading and the information will be in the right-hand panel.

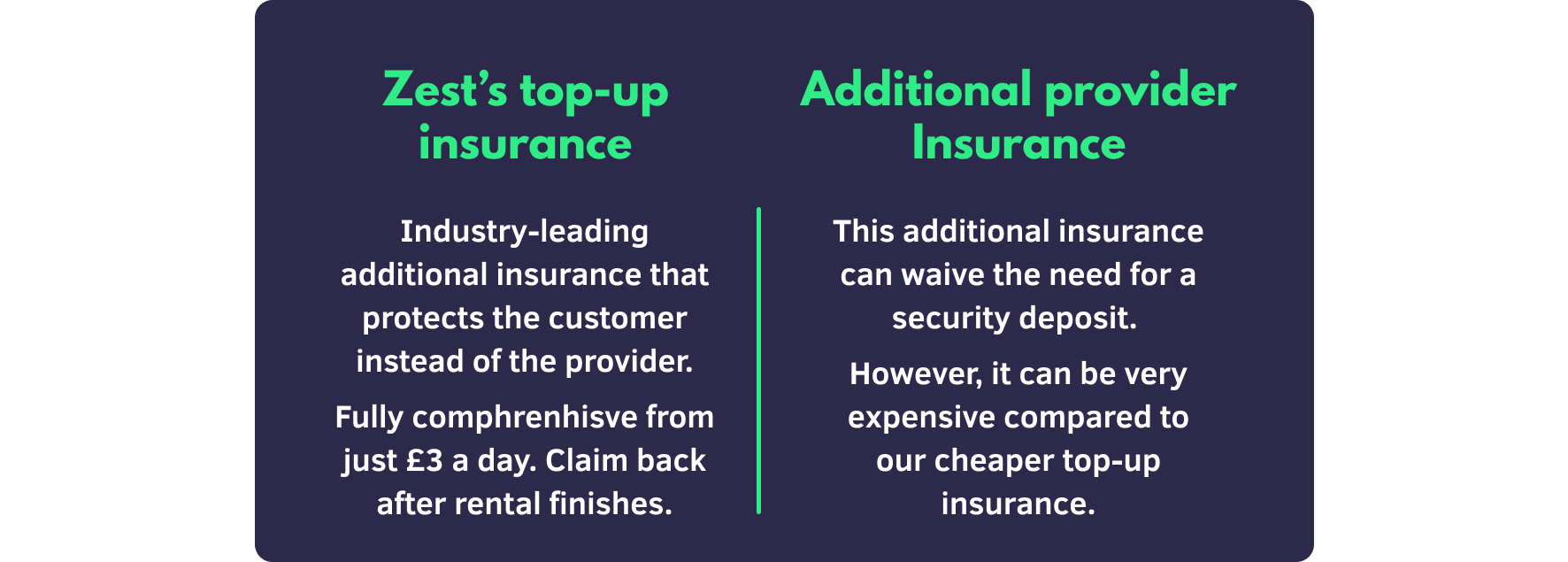

2.9 Zest’s Top-up insurance

Top-up insurance is the top level of cover available. It provides reimbursement cover against any loss or damage to the vehicle not covered by the standard insurance. This includes damage to the wheels, tyres, glass, underbody, roof, keys, locks or loss due to misfuelling, lockouts, and battery failure. It also covers mobile phone charges, curtailment, car-jacking, and road-rage incidents.

Want to know more about our Top-up insurance? Our bitesize Top-up insurance blog explains in detail what the additional insurance will cover for you.

3 Provider’s selling their own insurance at the desk

A lot of the confusion about car hire insurance comes from the confusion about the car hire providers local insurance and the host of the other offerings.

To be clear, in this context when we say provider, we mean the actual car hire provider and the insurance packages they sell. These are often hard sold when people arrive at the collection desk and are told the car can not be driven without it. However, this isn’t true.

3.1 Pros of taking provider’s insurance

An advantage of taking rental companies’ insurance is that you likely will not need to leave a security deposit. This is the amount held on your credit card whilst you’re renting the car in the unlikely event it gets damaged. If the car is returned in its original condition, the full amount is released back to your credit card. Need to know more about security deposits? Check out our guide on car hire security deposits.

For the most part, when taking the rental company’s insurance, a security deposit is not needed. This is perfect for when you don’t have enough funds on your credit card or if you simply don’t have a credit card at all. If you don’t want to leave a security deposit some of our providers offer no security deposit, and therefore no credit card is required. Use our filter on the quote results to only search for ‘no security deposit’. Remember to always check the terms as some will still require a credit card, just nothing is ‘held’.

3.2 Cons of taking provider insurance

The disadvantage of taking the insurance offered at the counter is the cost. Car hire company insurance is quite expensive and can be around 30-40 euros per day. Making a weekly rental seriously pricey! Again, it’s entirely your choice if you decide to choose this. For those looking for something cheaper, our Top-up insurance starts at £3 a day. Just remember you will still need to leave a security deposit if you decide to use our Top-up insurance.

If you’re being pushed into purchasing insurance at the counter and you’re not entirely sure you need it, don’t sign the contract. Once this is signed, you won’t be able to back out of it. If you’ve got any questions and you’ve booked with us, you can call us on our helpline and we will assist you. The Zest support team can explain the situation and even talk to the representative at the desk on your behalf if needed.

3.3 Providers being forceful about selling their insurance

A common car hire story is the dreaded upsell at the front desk where customers are told their insurance isn’t valid or that they need to sign up for their insurance. Why do these questions come up so often?

Car rental providers may not recognise third-party insurance policies because the policy isn’t provided by them or connected with them in any way. Third-party insurance such as Top-up Insurance protects you, the customer, and not the car rental provider. Providing you’ve met the terms and conditions of the policy the Top-up insurance should be valid. If you find yourself in this situation, you should contact Zest Car Rental immediately on our helpline.

The hard sell

The hard sell is a tactic used by some less reputable car hire providers and even encouraged by some brokers. In this scenario, the car rental provider rep will attempt to push the customer into taking out their expensive insurance at the collection desk. Sometimes reps can be extra relentless and threaten the customer with a charge or rental refusal if they don’t pay for the extra insurance!

3.4 Why do hard sells happen?

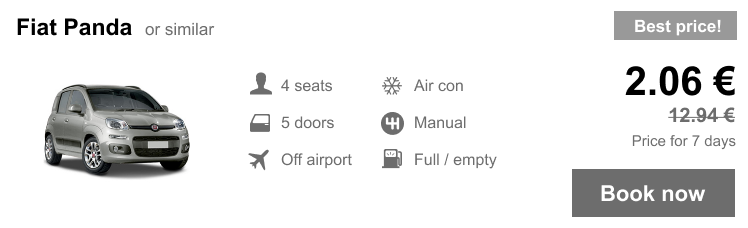

To explain why this happens, let’s look at a common car hire industry practice. Companies who advertise car hire for 2.06 EUR for a full 7 days are likely to hard-sell insurance to make a profit. This goes without saying that no customer will ever end up just paying 2.06 EUR and it is simply a deceiving method for reeling you in. To make up for the absurdly low prices, car hire companies forcibly upsell extra insurance. The company can then try to make up more money with damage charges and extra fees. Car hire companies charge a really low headline price and make up their profits by charging the customer for extras, we also call this the budget airline effect.

If you’ve not booked an unrealistically priced rental car and still experience the hard sell, it could just be a bad habit on the side of the provider. At Zest, we actively avoid working with companies that needlessly hard sell and monitor our current providers to make sure our customers are given no hidden costs.

3.5 How do I say no to the hard sell

You can always politely decline the extra products despite all the pressure to say yes. There are some conditions to this which we’ll explain below, but for most people, it is ok to just say no to any expensive extras you’re being offered. As long as you’re polite and firm with your answer, you should be ok. If a rep is being persistent, we’re always available for help if you get in touch.

3.6 Avoiding the hard sell with Zest

Unlike most car hire brokers, we actively discourage this sort of behaviour. We’re always monitoring the service of the providers we use and we will stop working with any who continue to do this. By default, booking through us ensures that you have everything you need to drive away hassle-free. Of course, if you feel like you want the extra protection we do offer optional Top-up insurance but you can instead take out the provider’s local insurance if you so wish. In our experience, our Top-up insurance offers complete protection but the cover you choose to take out is completely up to you.

This is sometimes why our prices are not the lowest in the market. We’d rather offer a comprehensive, simple package to our customers, instead of bargain-basement prices with hidden charges and hard upsells.

3.7 Some conditions about the hard sell

Sometimes, a rep can be pushy about extra insurance for a valid reason. Of course, these will always be made clear to you when booking to ensure there are no surprises at the desk.

- Young and old drivers are usually required to take out extra insurance.

- If a security deposit is required and you don’t have a valid credit card in the driver’s name, the local insurance can sometimes waive the need for a deposit.

- Out of choice, some people simply prefer to take out this insurance and not leave a security deposit.

4. What happens if you have a crash in a rental car?

The exact insurance procedure that you’ll follow depends entirely on the insurance setup of your particular hire. This is subject to change wildly between different brokers and providers.

This means that the best advice that we can give if you’re involved in an incident that’s not your fault is to do the two things listed below:

- Report the incident to the car hire provider, immediately.

- Take photos for evidence and find any witnesses if possible.

- If police are involved, get a police report.

If you do both of these things as soon as possible after an incident, you’ll make your likelihood of a successful insurance claim much higher.

5 Car hire insurance FAQs

What is Zest’s Top-up insurance and what does it cover?

Top-up insurance is the top level of cover available provided by us! You’ll receive reimbursement cover against any loss or damage to the vehicle not covered by the car hire insurance. This includes parts such as wheels, tyres, glass, underbody, roof, keys, locks, misfuelling, lockouts, and battery failure. Top-up insurance also covers mobile phone charges, curtailment, carjacking, and road-rage incidents.

Should I buy an annual car hire insurance policy?

This all depends on how often you use rental cars. Many annual policies cost over £40 so if you only hire a car for a couple of weeks a year, you’d be more suited to purchasing Top-up insurance through Zest Car Rental.

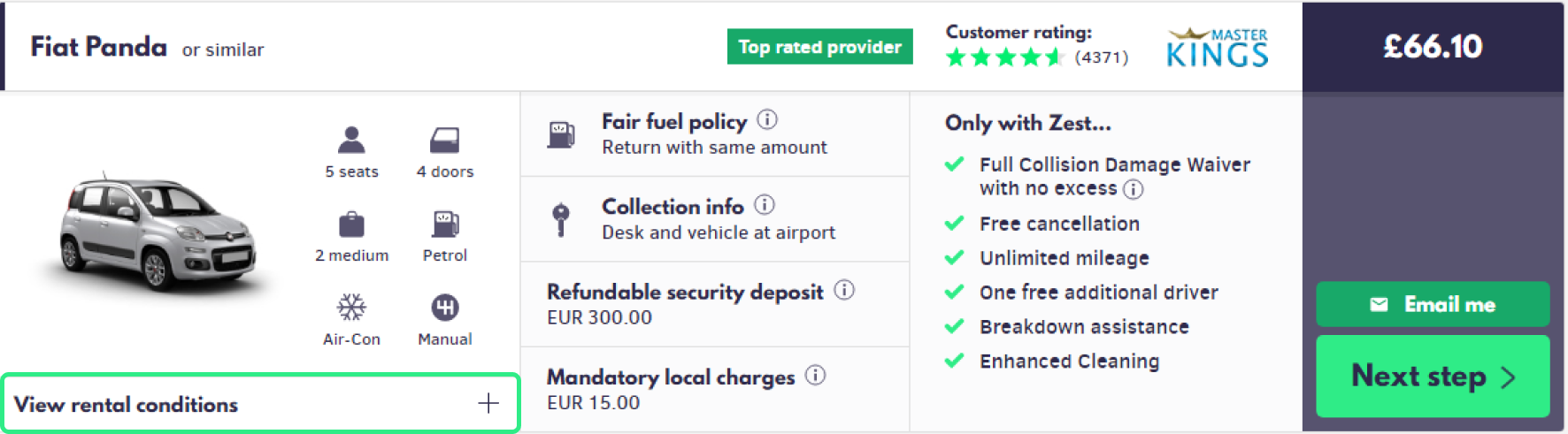

What does my insurance include?

This varies depending on what car you’re renting and which provider you’re using. When viewing your quote with Zest, click the ‘View Rental Conditions’ tab underneath each vehicle. Search for the heading marked Deposit Requirements and you will find the relevant information about the insurance.

What shall I do if I am offered additional insurance when I collect my rental car?

Many providers try to sell additional insurance when you collect the car. Damage to items that are not included in their standard insurance such as wheels, tyres and glass will be covered. Taking this insurance is entirely at your discretion. If you have already taken out Top-up insurance there is NO point in taking out additional insurance.

My car rental provider is saying my Top-up insurance isn’t valid?

Don’t panic, your Top-up insurance is valid. Top-up protects you first and the provider second so the provider would rather you buy their insurance which protects them first and you second. Our main goal at Zest is to look after our customers, if you have any issues regarding this, contact our customer support team immediately.

I’ve taken out both the Top-up insurance and the provider’s insurance, what should I do?

Unfortunately, you will be unable to refund the cost of insurance once you’ve used the car for that period even if it wasn’t required as you’ve signed a contract agreeing to the terms.

Why can’t I get a refund on my car hire insurance when I didn’t make a claim?

Similar to your personal car insurance, you will not be granted a refund. Although you may not have made a claim, the policy has still been in place for the duration of your car rental for you to use if necessary. Therefore, the insurance was still provided and the cost can’t be refunded.

Ready to book with Zest?

With this Car Hire Insurance Guide, you should have what it takes to be an expert in car rental and car rental insurance! However, if you still have any questions or queries about car hire we are more than happy to help assist you with our customer support service.

Book your dream rental car with industry-leading protection!

View our full Booking Terms and Conditions.